UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Exchange Act of 1934

| ¨ Filed by a Party other than the Registrant |

Check the appropriate box: | ||||

¨ | Preliminary Proxy Statement | |||

¨ | ||||

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | ||||

x | ||||

Definitive Proxy Statement | ||||

¨ | ||||

Definitive Additional Materials | ||||

¨ | Soliciting Material | |||

SUNTRUST BANKS, INC.

(Name of Registrant as Specified In Its Charter)

| Payment of Filing Fee (Check the appropriate box): | ||||

x | No fee required. | |||

¨ | ||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

| (1) | Title of each class of securities to which | |||

| (2) | Aggregate number of securities to which | |||

| (3) | Per unit price or other underlying value of | |||

| (4) | Proposed maximum aggregate value of | |||

| (5) | Total fee paid: | |||

¨ | ||

| Fee paid previously with preliminary materials. | ||

¨ | ||

| Check box if any part of the fee is offset as provided by Exchange Act Rule | ||

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

To the Shareholders of

The Annual Meeting of Shareholders of SunTrust Banks, Inc. will be held in Suite 105 on the 1st floorAtrium level of SunTrust Plaza Garden Offices, 303 Peachtree Center Avenue, Atlanta, Georgia, 30308 on Tuesday, April 23, 2013,26, 2016, at 9:30 a.m. local time, for the following purposes:

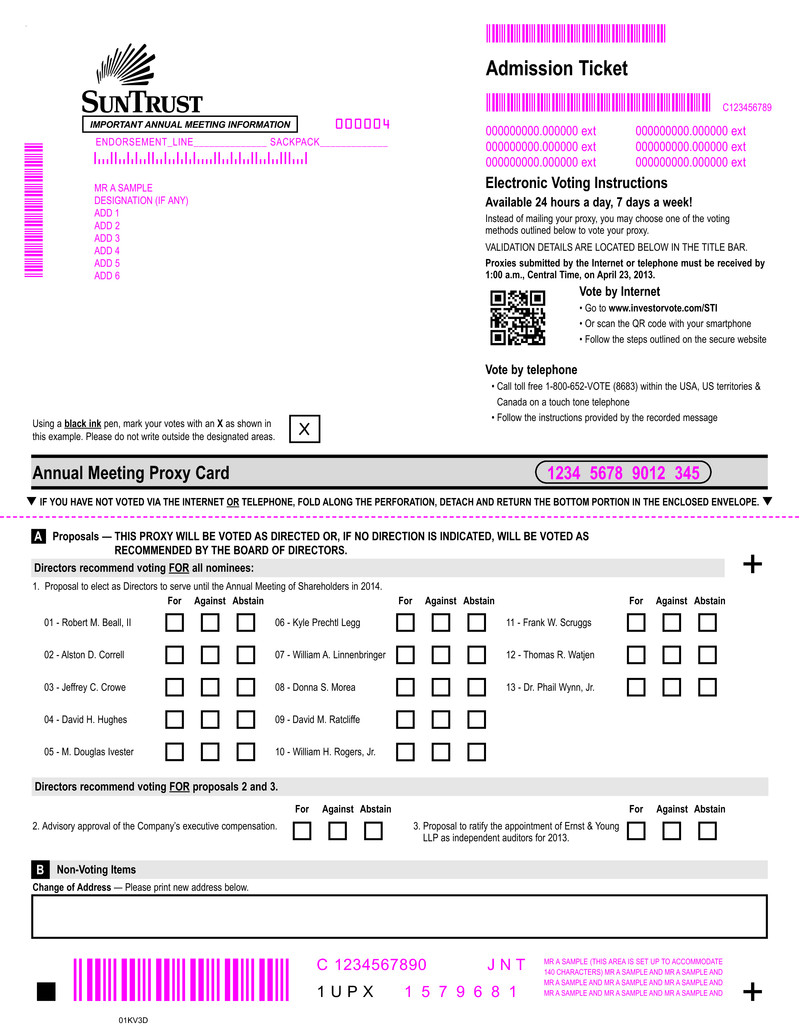

| 1. | To elect 11 directors nominated by the Board of Directors to serve until the next annual meeting of shareholders and until their respective successors have been elected, |

| 2. | To approve, on an advisory basis, the Company’s executive compensation, and |

| 3. | To ratify the appointment of Ernst & Young LLP as our independent auditor for 2016. |

Only shareholders of record at the close of business on February 13, 201317, 2016 will be entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

For your convenience, we will offer an audio webcast of the meeting. If you choose to listen to the webcast, go to

BY ORDER OF THE BOARD OF DIRECTORS

Raymond D. Fortin,

Corporate Secretary

March 14, 2016

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to the attachedBe Held on April 26, 2016. The 2016 Proxy Statement and the 2015 Annual Report to Shareholders for more complete information regarding the matters to be acted uponyear ended December 31, 2015 are also available at the Annual Meeting.

IMPORTANT NOTICE

| ||

| PROXY SUMMARY | 1 |

| 3 |

5 | ||

5 |

| 5 | |

7 |

| 8 |

8 | ||

8 | ||

| Codes of Ethics and Committee Charters | 9 | |

| 9 | ||

| 9 | ||

| 10 | ||

| 10 | ||

Policies and Procedures for Approval of Related Party Transactions | 10 | |

Transactions with Related Persons, Promoters, and Certain Control Persons | 11 | |

| 11 |

11 | ||

11 | ||

11 | ||

12 | ||

12 | ||

| 12 | ||

12 | ||

13 | ||

14 | ||

14 | ||

14 |

| 15 | ||||||

| 17 | ||||||

17 | ||

31 | ||

| 31 | ||

32 | ||

33 |

34 | ||

35 | ||

36 | ||

38 | ||

39 |

| 42 | ||||||

| 44 | ||||||

| 45 | ||||||

| OTHER INFORMATION | 46 | |||||

| 46 | ||

| 46 | ||

| 46 | ||

| 46 |

| 47 | ||

| 47 | ||

| 47 | ||

SUNTRUST BANKS, INC.

303 PEACHTREE STREET, N.E.

ATLANTA, GEORGIA 30308

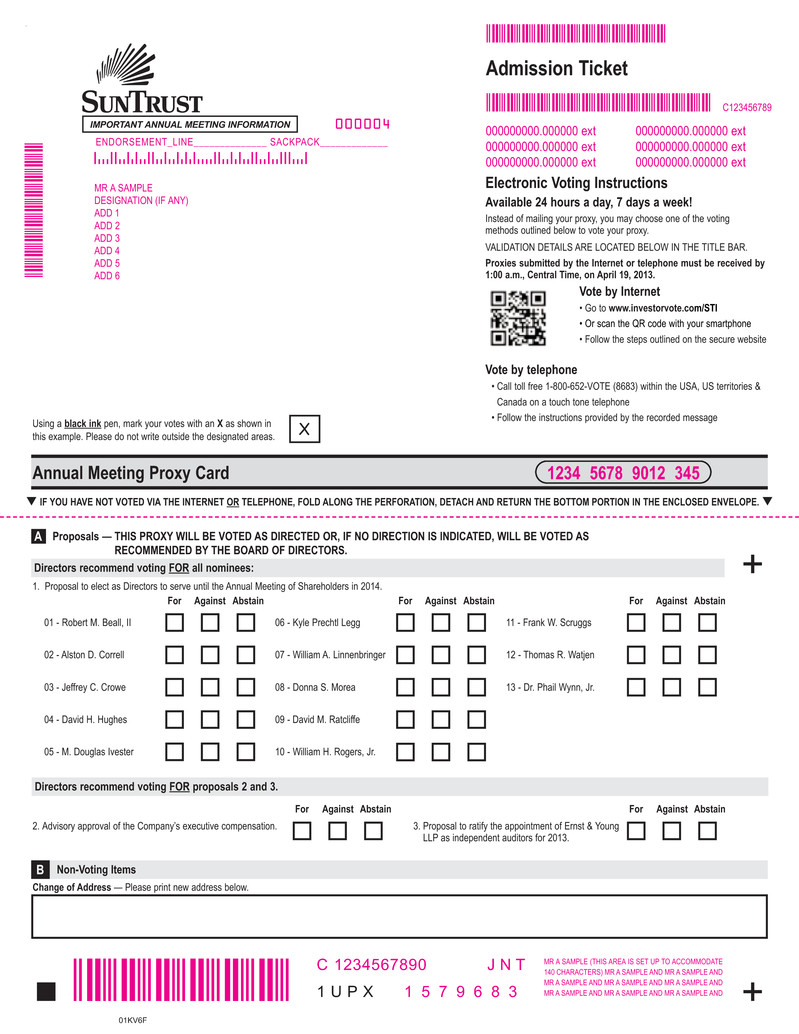

2016 ANNUAL MEETING OF SHAREHOLDERS The following executive summary is intended to provide a broad overview of the items that you will find elsewhere in this proxy statement. As this is only a summary, we encourage you to read the entire proxy statement for more information about these topics prior to voting. Date and Time: | April | |||||

| 26, 2016 at 9:30 AM Place: | ||||||

| 30308 Record Date: February 17, 2016 Audio Webcast: investors.suntrust.com | ||||||

How to Vote: | ||||||

| ||||||

| calling toll-free 1-800-652-VOTE (8683) | |||||

| returning the | |||||

|

| |||||

SunTrust at a Glance

| General1 | ||||

| Governance | Compensation | |||

• 1,401 branches • $191 billion total assets • 24,043 teammates2 • NYSE: STI | ||||

• all independent directors other than CEO | • | |||

• | ||||

• | ||||

• 8 of 10 independent director nominees joined since 2010. | • • share ownership and retention requirements • 70% of NEO target long-term compensation is at risk | |||

• double-triggers required for Change-in- Control severance | ||||

| 1 |

as of December 31, 2015. |

| Proposal | Board’s Voting Recommendation | Page References (for more detail) | ||||

| 1. | Election of Directors | FOR EACH NOMINEE | 12-14 | |||

| 2. | Advisory Vote To Approve Executive Compensation | FOR | 48 | |||

| 3. | Approval of Independent Accountants | FOR | 50 | |||

| 2 |

full-time equivalent employees |

| Director | Age | Director Since | Independent | Committees | |||

| Robert M. Beall, II | 69 | 2004 | ü | AC, CC | |||

| Alston D. Correll | 71 | 1997 | ü | CC, EC, RC | |||

| Jeffrey C. Crowe | 66 | 2004 | ü | CC, EC, RC | |||

| David H. Hughes | 69 | 1984 | ü | GN, RC | |||

| M. Douglas Ivester | 65 | 1998 | ü | EC, GN, RC | |||

| Kyle Prechtl Legg | 61 | 2011 | ü | AC, CC | |||

| William A. Linnenbringer | 64 | 2010 | ü | AC, GN | |||

| Donna S. Morea | 58 | 2012 | ü | AC, GN | |||

| David M. Ratcliffe | 64 | 2011 | ü | CC, RC | |||

| William H. Rogers, Jr. | 55 | 2011 | CEO | EC | |||

| Frank W. Scruggs | 61 | n/a | ü | nominee | |||

| Thomas R. Watjen | 58 | 2010 | ü | AC, EC, GN | |||

| Dr. Phail Wynn, Jr. | 65 | 2004 | ü | AC, GN | |||

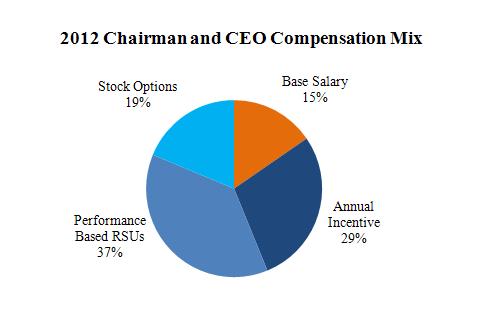

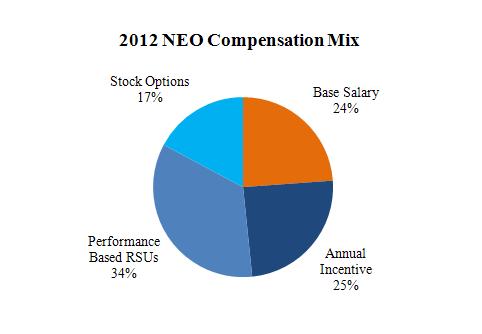

Our shareholders have the opportunity to cast a non-binding advisory vote to approve our executive compensation. We recommend that you review our Compensation DiscussionMeeting Agenda and Analysis, which begins on page 20, which explains the actions and decisions of the Compensation Committee of the Board during Voting Recommendation

2012 regarding our compensation programs, as well as the accompanying compensation tables and related narrative. We are pleased that last year our shareholders approved the compensation of our named executive officers by more than 90% of votes cast.

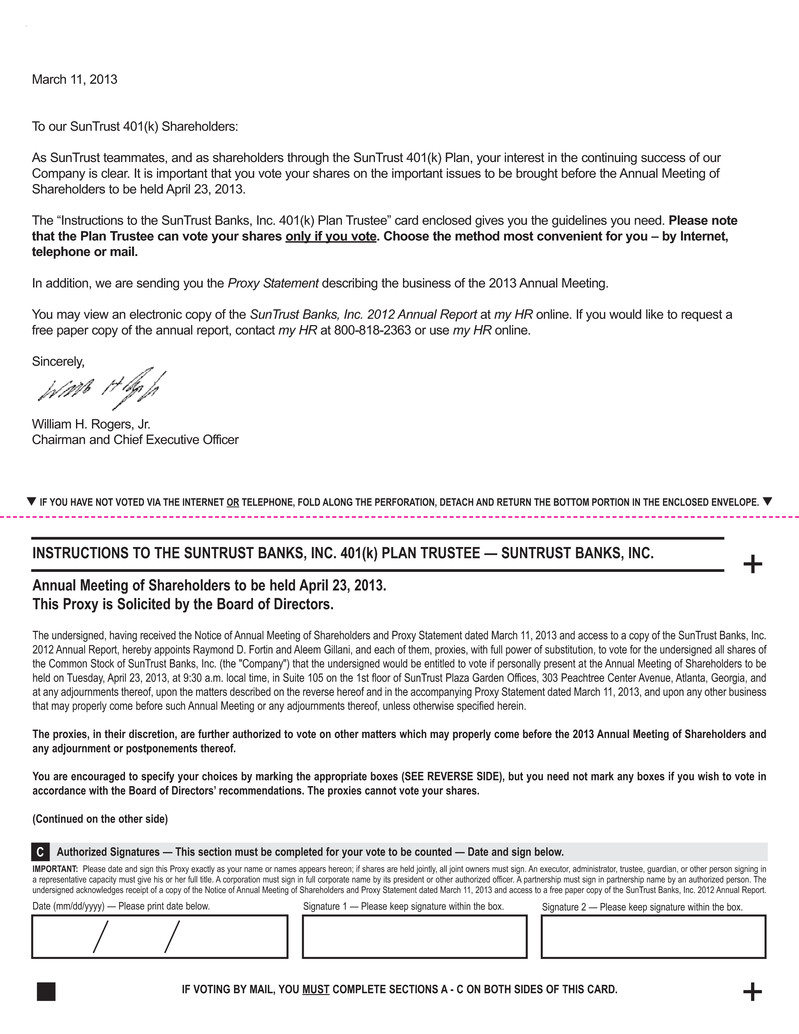

The enclosed proxy is solicited on behalf of the Board of Directors of SunTrust Banks, Inc. in connection with the Annual Meeting of Shareholders of SunTrust to be held in Suite 105 on the 1st floorAtrium level of SunTrust Plaza Garden Offices, 303 Peachtree Center Avenue, Atlanta, Georgia, 30303,30308, on Tuesday, April 23, 2013,26, 2016, at 9:30 a.m. local time. We are first mailing this Proxy Statementproxy statement and the enclosed proxy to our shareholders on or about March 11, 2013.14, 2016. We will bear the cost of soliciting proxies. SunTrust has retained Georgeson Shareholder Communications, Inc. to assist in the solicitation of proxies for a fee of $10,000$10,000 plus expenses. Proxies may also be solicited by our employees. Proxies may be solicited in person, by physical and electronic mail, and by telephone call.

| SunTrust Banks, Inc. - 2016 Proxy Statement | 1 |

Proxy Summary

| Proposal | Board’s Recommendation | Page Reference | ||

1. Election of 11 Directors | FOR EACH | 3 | ||

2. Advisory Vote To Approve Executive Compensation | FOR | 42 | ||

3. Ratification of Independent Auditor | FOR | 44 |

Director Nominees (Proposal No. 1, page 3)

Each director nominee is elected annually by a majority of votes cast. See pages 3-4 of this proxy statement for more information.

| Director | Age | Since | Tenure | Independent | Committees | |||||

Dallas S. Clement | 50 | 2015 | 0 | ü | AC, GN | |||||

Paul R. Garcia | 63 | 2014 | 1 | ü | CC, RC | |||||

M. Douglas Ivester | 68 | 1998 | 17 | ü | EC, GN, RC | |||||

Kyle Prechtl Legg | 64 | 2011 | 4 | ü | AC, CC,* EC | |||||

Donna S. Morea | 61 | 2012 | 3 | ü | CC, RC | |||||

David M. Ratcliffe | 67 | 2011 | 4 | ü | CC, EC, RC* | |||||

William H. Rogers, Jr. | 58 | 2011 | 4 | CEO | EC* | |||||

Frank P. Scruggs, Jr. | 64 | 2013 | 2 | ü | CC, RC | |||||

Bruce L. Tanner | 57 | 2015 | 0 | ü | GN, RC | |||||

Thomas R. Watjen | 61 | 2010 | 5 | ü | AC,* EC, GN | |||||

Dr. Phail Wynn, Jr. | 68 | 2004 | 11 | ü | AC, EC, GN* |

AC | Audit Committee | EC | Executive Committee | |||

CC | Compensation Committee | GN | Governance and Nominating Committee | |||

* | Committee Chair | RC | Risk Committee |

Advisory Vote to Approve Executive Compensation (Proposal No. 2, page 42)

Our shareholders have the opportunity to cast a non-binding advisory vote to approve our executive compensation. We have providedrecommend that you review our Compensation Discussion and Analysis, which begins on page 17 for a description of the enclosed proxyactions and decisions of the Compensation Committee of the Board during 2015 regarding our compensation programs, as well as the accompanying compensation tables and related narrative. We are pleased that last year our shareholders approved executive compensation by more than 90% of votes cast.The Board of Directors recommends a voteFOR the proposal.

Ratification of the Independent Auditor (Proposal No. 3, page 44)

Ernst & Young LLP has served as the Company’s independent registered public accounting firm since 2007. Shareholders are being asked to ratify the appointment of Ernst & Young by the Audit Committee for use if you are unable to attend2016.

The Board of Directors recommends a voteFOR the proposal.

| 2 | SunTrust Banks, Inc. - 2016 Proxy Statement |

Nominees for Directorship (Item 1)

Nominees for Directorship (Item 1)

Upon the recommendation of its Governance and Nominating Committee, the Board nominated the following 11 persons for election as directors at the Annual Meeting in person or wish2016: Dallas S. Clement, Paul R. Garcia, M. Douglas Ivester, Kyle Prechtl Legg, Donna S. Morea, David M. Ratcliffe, William H. Rogers, Jr., Frank P. Scruggs, Jr., Bruce L. Tanner, Thomas R. Watjen, and Phail Wynn, Jr. Each of the 11 persons nominated for election, if elected, is expected to have your shares voted by proxy even if you attendserve until next year’s annual meeting of shareholders and until their successor is elected and qualified. If, at the Annual Meeting. Whether or not you plan to attendtime of the Annual Meeting, please vote yourany of the nominees should be unable or decline to serve as a director, the proxies are authorized to be voted for such substitute nominee or nominees as the Board recommends. The Board has no reason to believe that any nominee will be unable or decline to serve as a director.

The number of shares by: (1)of common stock beneficially owned by each nominee for director is listed under the heading “Stock Ownership of Directors, Management and Principal Shareholders” on page 45.

Below is a toll-free telephone call, (2)description of each nominee, the Internet,director’s age, the year in which the person first became a director of SunTrust, and a brief description of the experience, attributes, and skills considered by the Governance and Nominating Committee and the Board. Except for Mr. Rogers, our CEO, none of the nominees or (3) completing, signing, datingdirectors is employed by SunTrust or any affiliate of SunTrust. Robert M. Beall, II, David H. Hughes, and returningWilliam A. Linnenbringer will retire from the enclosed proxyBoard following this year’s meeting.

Dallas S. Clement, 50, has been a director since 2015. He is Executive Vice President and Chief Financial Officer of Cox Enterprises, responsible for its treasury, financial reporting and control, as soonwell as possibletax, audit and financial planning and analysis functions. Previously, he served as Executive Vice President and Chief Financial Officer for Cox Automotive, the largest automotive marketplace and leading provider of software solutions to auto dealers throughout the U.S. He presently serves on the board of the BitAuto, and previously served on the board of Unwired Planet.

Mr. Clement’s financial and business experience, including service as a CFO of a large customer-facing company with significant technology operations, well qualifies him to serve on our Board.

Paul R. Garcia, 63, has been a director since 2014. Mr. Garcia is the retired Chairman and CEO of Global Payments Inc., a leading provider of credit card processing, check authorization, and other electronic payment processing services. Mr. Garcia also serves as a director of The Dun & Bradstreet Corporation and West Corporation. Previously, he served on the board of Mastercard International.

Mr. Garcia’s extensive knowledge of and experience in the postage paid envelope provided. You can simplify your votingpayment services and reducefinancial services industries, and his service as a Chairman and CEO of a publicly-traded company, well qualify him to serve on our costs by voting your shares via telephone orBoard.

M. Douglas Ivester, 68, has been a director since 1998 and has been our Lead Director since 2009. He is President of Deer Run Investments, LLC. From 1997 until 2000, Mr. Ivester was Chairman of the Internet. We have designedBoard and Chief Executive Officer of The Coca-Cola Company. Mr. Ivester spent more than 20 years with The Coca-Cola Company and held such positions as Chief Financial Officer and President and Chief Operating Officer, where he was responsible for running the telephonecompany’s global business. Previously, he served as a director of S1 Corporation and Internet voting proceduresGeorgia-Pacific Corporation.

Mr. Ivester’s long and varied business career, including service as Chairman and CEO of a large, publicly-traded company and deep financial and accounting experience gained while serving as a Chief Financial Officer, well qualify him to allow shareholders to vote their shares and to confirm that their instructions haveserve on our Board.

Kyle Prechtl Legg, 64, has been properly recorded. If you hold your sharesa director since 2011. She is the former Chief Executive Officer of Legg Mason Capital Management (LMCM). Ms. Legg has more than 30 years of professional experience in the nameinvestment industry. At LMCM, she built a leading global equity investment management business serving high-end institutional clients, including some of the world’s largest sovereign wealth funds, domestic and foreign company pension plans, corporate funds, endowments, and foundations. Ms. Legg is also a director of OMAM plc, Brown Advisory Funds and previously served as a director of the Eastman Kodak Company.

Ms. Legg’s deep investment, financial, and executive leadership experience, including experience with a regulated financial institution, well qualify her to serve on our Board.

Donna S. Morea, 61, has been a director since 2012. Ms. Morea is a nationally recognized executive in IT professional services management with over 30 years of experience. From May 2004 until her retirement at the end of 2011, Ms. Morea served as President of CGI Technology and Solutions, Inc., a wholly-owned U.S. subsidiary of CGI Group, one of the largest independent information technology firms in North America. In that role, she led CGI’s IT and business process services in the US and India for large enterprises in financial services, healthcare, telecommunications and government. She previously served on CGI Group’s board of directors and presently serves on the board of Science Applications International Corporation, a publicly-traded firm which provides technical, engineering, and enterprise information technology services. She also served as the Chair of the Northern Virginia Technology Council, with over 1000 member organizations.

| SunTrust Banks, Inc. - 2016 Proxy Statement | 3 |

Nominees for Directorship (Item 1)

Ms. Morea’s management experience and information technology expertise well qualify her to serve on our Board.

David M. Ratcliffe, 67, has been a director since 2011. Mr. Ratcliffe retired in December 2010 as Chairman, President and Chief Executive Officer of Southern Company, one of America’s largest producers of electricity, a position he held since 2004. From 1999 until 2004, Mr. Ratcliffe was President and CEO of Georgia Power, Southern Company’s largest subsidiary. Prior to becoming President and CEO of Georgia Power in 1999, Mr. Ratcliffe served as Executive Vice President, Treasurer and Chief Financial Officer. Mr. Ratcliffe also serves as a member of the board of CSX, a publicly-traded railroad.

Mr. Ratcliffe’s experience as a director and chief executive officer of a bank or broker,highly-regulated, publicly-traded company well qualifies him to serve on our Board.

William H. Rogers, Jr., 58, has been a director since 2011 and has served as Chairman of our Board since January 1, 2012. He was named Chief Executive Officer in June 2011 after having served as our Chief Operating Officer since 2010 and President since 2008. Mr. Rogers began his career in 1980 and has served in a leadership capacity in all segments of the availabilityCompany. Mr. Rogers previously served as a director of telephoneBooks-a-Million, Inc. and Internet voting will dependpresently serves as a director of the Federal Reserve Bank of Atlanta.

Mr. Rogers’ long history with our company and industry well qualify him to serve on our Board.

Frank P. Scruggs, Jr., 64, has been a director since 2013. He has been a partner in the law firm of Berger Singerman LLP since 2007 where he represents companies and executives in employment law matters and litigates commercial disputes. Prior to joining Berger Singerman, he was an Executive Vice President for Office Depot, Inc. and was a shareholder of the law firm Greenberg Traurig LLC. He previously served as the Florida Secretary of Labor and Employment Security, as a member of the Florida Board of Regents, and on the votingboard of directors of Office Depot, Inc.

Mr. Scruggs’ extensive governmental affairs, legal, and regulatory experience well qualify him to serve on our Board.

Bruce L. Tanner, 57, has been a director since 2015. He has served as Executive Vice President and Chief Financial Officer for Lockheed Martin Corporation since 2007. As Chief Financial Officer, he is responsible for all aspects of Lockheed’s financial strategies, processes, and operations.

Mr. Tanner’s financial and business experience, including service as a CFO of a highly-regulated, publicly-traded company with operations in substantial portions of our service territory well qualifies him to serve on our Board.

Thomas R. Watjen, 61, has been a director since 2010. In 2015, he retired as the President and Chief Executive Officer of Unum Group, a publicly-traded insurance holding company, and serves as the Chairman of its board. He was employed by Unum or its predecessors since 1994, initially as its Chief Financial Officer. Prior to joining Unum, he served as a Managing Director of the applicable bankinsurance practice of the investment banking firm Morgan Stanley & Co.

Mr. Watjen’s experience as a director, chief executive officer, and chief financial officer of a publicly-traded company and executive experience with a regulated financial services company well qualify him to serve on our Board.

Phail Wynn, Jr., 68, has been a director since 2004. He has been the Vice President for Durham and Regional Affairs for Duke University since January 2008. Previously, he served as the President of Durham Technical Community College from 1980 to 2007. Dr. Wynn has served continuously as a director of one or broker. Therefore, we recommend that you follow the voting instructionsmore financial institutions since 1992. Dr. Wynn is also a director of North Carolina Mutual Life Insurance Company.

Dr. Wynn’s varied business and academic experiences, including his long service on the form you receive from your bank or broker. If you do not chooseboards of financial institutions, well qualify him to vote by telephone or the Internet, please complete, date, sign and return the proxy card.serve on our Board.

The Board of Directors which we referrecommends a voteFOR all nominees.

| 4 | SunTrust Banks, Inc. - 2016 Proxy Statement |

Nominees for Directorship (Item 1)

Board Committees and Attendance

The Board has created certain standing and ad hoc committees. These committees allow regular monitoring and deeper analysis of various matters. The committee structure also allows committees to as the “Board.”

Regular meetings of the webcast onBoard are held at least quarterly. During 2015, the Investor Relations website beginning the afternoon of

directors in executive session. All incumbent directors attended at least 75% of the aggregate number of Board meetings and meetings of the committees on which they served. In addition, all of our incumbent directors who were serving as directors at such time attended last year’s annual meeting of shareholders. Abstentions and broker non-votes will be counted as “shares present” in determining whether a quorum exists at the Annual Meeting.

The Board reviews the membership of the committees from time to vote only on Item 3 (the ratificationtime. Specific committee assignments are proposed by the Governance and Nominating Committee in consultation with the chair of Ernst & Young LLP as our independent auditor),each committee and not on Items 1with the consent of the member, and 2 (electionare then submitted to the full Board for approval. The current membership of directorsthese committees, and say-on-pay). Accordingly, it is important that you provide voting instructions to your broker or other nominee so that your shares may be voted.

Membership by another nominee, you must obtainDirector

| Governance & | ||||||||||

| Audit | Compensation | Executive | Nominating | Risk | ||||||

| Number of Meetings Held: | 13* | 6 | 5 | 6 | 13* | |||||

Robert M. Beall, II* | ü | ü | ||||||||

Dallas S. Clement | ü | ü | ||||||||

Paul R. Garcia | ü | ü | ||||||||

David H. Hughes* | ü | ü | ||||||||

M. Douglas Ivester | ü | ü | ü | |||||||

Kyle Prechtl Legg | ü | Chair | ü | |||||||

William A. Linnenbringer* | ü | ü | ||||||||

Donna S. Morea | ü | ü | ||||||||

David M. Ratcliffe | ü | ü | Chair | |||||||

William H. Rogers, Jr. | Chair | |||||||||

Frank P. Scruggs, Jr. | ü | ü | ||||||||

Bruce L. Tanner | ü | ü | ||||||||

Thomas R. Watjen | Chair | ü | ü | |||||||

Dr. Phail Wynn, Jr. | ü | ü | Chair |

| * | number of meetings does not include three joint sessions of the Audit and Risk Committees |

| Audit | Compensation | Executive | Governance & Nominating | Risk | ||||

| Mr. Watjen,Chair | Ms. Legg, Chair | Mr. Rogers, Chair | Dr. Wynn,Chair | Mr. Ratcliffe, Chair | ||||

| Mr. Beall* | Mr. Beall* | Mr. Ivester | Mr. Clement | Mr. Garcia | ||||

| Mr. Clement | Mr. Garcia | Ms. Legg | Mr. Hughes* | Mr. Hughes* | ||||

| Ms. Legg | Ms. Morea | Mr. Ratcliffe | Mr. Ivester | Mr. Ivester | ||||

| Mr. Linnenbringer* | Mr. Ratcliffe | Mr. Watjen | Mr. Linnenbringer* | Ms. Morea | ||||

| Dr. Wynn | Mr. Scruggs | Dr. Wynn | Mr. Tanner | Mr. Scruggs | ||||

| Mr. Watjen | Mr. Tanner |

| * | will retire immediately following the annual meeting of shareholders. |

| SunTrust Banks, Inc. - 2016 Proxy Statement | 5 |

Nominees for Directorship (Item 1)

TheAudit Committee:

appoints, compensates, retains, and bringdirectly oversees the work of our independent auditor (subject to shareholder ratification, if applicable).

is charged with monitoring the Annual Meeting a proxy orintegrity of our financial statements, the independence and qualifications of our independent auditor, our system of internal controls, the performance of our internal audit process and independent auditor, and our compliance with laws, regulations and the codes of conduct.

also resolves any disagreements between management and the auditors regarding financial reporting.

pre-approves all audit services and permitted non-audit services provided to SunTrust by its independent auditor.

performs other evidence of ownership from your broker or nominee giving you the right to vote such shares if you wish to ask a question. If yourelated duties as defined in its written charter.

Our Audit Committee has only members that are a shareholder of record and received your proxy materials (or notice of internet availability of proxy materials) by mail, your admission ticket is attached to your proxy card (or notice of internet availability of proxy materials). If you received your proxy materials by e-mail and voted your shares electronically via the Internet, you can print an admission ticket after you have voted by clicking on the link provided. If you are a beneficial owner, bring the notice or voting instruction form you received from your bank, brokerage firm or other nominee for admission to the meeting. You also may bring your brokerage statement reflecting your ownership of Common Stock as of February 13, 2013 with you to the meeting. Large bags, cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting, and individuals not complying with this request are subject to dismissal from the Annual Meeting. In the event of an adjournment, postponement or emergency that may change the Annual Meeting’s time, date or location, we will make an announcement, issue a press release or post information at www.SunTrust.com to notify shareholders as appropriate. If any other item or proposal may properly come before the meeting, including voting on a proposal omitted from this Proxy Statement pursuant to the rules of the SEC or incident to

TheCompensation Committee is responsible for

approving our stated compensation strategies, goals and purposes;

ensuring that there is a strong link between the economic interests of management and shareholders;

ensuring that members of management are rewarded appropriately for their contributions to Company growth and profitability;

ensuring that the executive compensation strategy supports both our objectives and shareholder (as they appearinterests;

ensuring that the incentive compensation arrangements for the Company do not encourage employees to take risks that are beyond our ability to manage effectively; and

administers the Incentive Compensation Recoupment Policy, and claws back compensation in appropriate circumstances; and

Our Compensation Committee has only members that are independent under our stock transfer records),Corporate Governance Guidelines and the classrules of the New York Stock Exchange.

TheExecutive Committeeregularly reviews operational performance and number of our shares beneficially ownedmonitors certain key financial performance indicators. It also reviews certain capital matters, including quarterly dividends and share repurchases. The Executive Committee also handles other matters assigned to it from time to time by the shareholder. In addition,Chairman or Lead Director.

TheGovernance and Nominating Committee is responsible for making recommendations to the proponent should provide a complete description of any material economic or other interestBoard regarding the size and composition of the proponentBoard, reviewing the qualifications of candidates to the Board, and of their affiliates and associates in order to satisfy the requirements of our bylaws and to allow us to satisfy the requirements of SEC Regulation 14A. Proposals should be addressed to SunTrust Banks, Inc., Post Office Box 4418, Mail Code 643, Atlanta, Georgia 30302, Attention: Corporate Secretary. In addition, SEC rules generally permit management to vote proxies in its discretion for such proposals (1) provided we advise shareholders in next year’s proxy statement about the nature of the matter and how management intends to vote on such matter, if we receive notice of the proposal on or after October 12, 2013 and before the close of business on November 11, 2013; and (2) provided we advise shareholders in next year’s Proxy Statement that such proxy will confer such authority and if we do not receive notice of the proposal on or after October 12, 2013 and before the close of business on November 11, 2013.

taking a leadership role in shaping our corporate governance;

developing and recommending to the Board a set of SunTrustcorporate governance guidelines, periodically reviewing and reassessing the adequacy of those principles, and recommending any proposed changes to the Board for approval;

leading the Board in its annual review of the Board’s performance; and

addressing committee structure and operations, reports to the Board, member qualifications and committee member appointment and removal.

It has sole authority for retaining or terminating any search firm used to identify director candidates and determining such firm’s fees. Our Governance and Nominating Committee also performs other related duties as defined in its written charter. It has only members that are independent under our Corporate Governance Guidelines and the rules of the New York Stock Exchange.

TheRisk Committee:

reports to and assists the Board of Directors in overseeing enterprise risk management such as credit, operational, compliance, market, liquidity, strategic, legal and reputational risk; enterprise capital adequacy; liquidity adequacy; and material regulatory matters.

Oversight and review includes, among other things, significant policies and practices employed to manage and assess credit risk, liquidity risk, market risk, operational risk, compliance risk, legal risk, strategic risk and reputational risk.

The Risk Committee oversees the enterprise risk management appetite and tolerances; risk frameworks; and policies that reflect the Board’s risk management philosophies and principles, or for which for which management oversight is mandated by law or regulation.

The Risk Committee oversees liquidity risk management activities, including the structure and adequacy of liquidity in light of current or planned business activities, and in light of the requirements or expectations of statutes, regulations, management, and the Board;

Capital management activities, including the structure and adequacy of capital in light of current or planned business activities, and management, Board and statutory/regulatory requirements or expectations.

Our Risk Committee has only members that are independent under our Corporate Governance Guidelines and the rules of the New York Stock Exchange.

| 6 | SunTrust Banks, Inc. - 2016 Proxy Statement |

The Governance and Nominating Committee determines the amount and form of director compensation. In 2015, it made minor adjustments to the amount and timing of director compensation based upon a specifiedreview of market and peer practices with the assistance of an independent compensation consultant. Its procedures for determining director includingcompensation are similar to those used by the Compensation Committee for executive compensation, described at “Executive Compensation Decision-Making Processes.”

We pay each non-employee director an annual retainer of $70,000 in four installments. The Chairs of each of the Audit Committee, Compensation Committee, Governance and Nominating Committee, and Risk Committee receive an additional retainer of $20,000, and the Lead Director the non-managementreceives an additional retainer of $30,000. We pay each non-employee director a fee of $1,500 for each committee meeting attended. Non-employee directors as a group, or a committee ofserving on the Board should send correspondence tofollowing our annual meeting of shareholders receive a grant of either restricted stock or restricted stock units, at their election, having a value of $120,000 on the Corporate Secretary at SunTrust Banks, Inc., P.O. Box 4418, Mail Code 643, Atlanta, Georgia 30302. All communications so received from shareholdersdate of grant. The grant vests upon the earlier of one year or other

The table below provides information concerning the compensation of the Board or to the applicable director orour non-employee directors if so designated by such person. Anyone who wishes to communicate with a specific Board member, only the non-managementfor 2015. Except as noted above, all of our non-employee directors or a committee should send instructions asking that the material be forwarded to the applicable director, group of directors or to the appropriate committee chair.

Directors may defer either or both of their desiremeeting and retainer fees under our Directors Deferred Compensation Plan. We determine the return on deferred amounts as if the funds had been invested in our common stock or at a floating interest rate equal to receive multiple copiesthe prime interest rate in effect at SunTrust Bank computed on the last day of each quarter, at the election of the Proxy Statement. This is known as “householding.” We do this to reduce costs and preserve resources. Upon oral or written request, we will promptly deliver a separate copy of this Proxy Statement, our annual report, or our notice of internet availability of proxy materials to any shareholder residing at an address to which only one copy was mailed. Requests for additional copies for the current year or future years, or requests for single copies to be delivered to a particular address rather than multiple copies, should be directeddirector.

| Name | Fees Earned or Paid In Cash | Stock1 Awards | NQDC Earnings | All Other Compensation | Total | |||||||||||||||

Robert M. Beall, II | $ | 91,000 | $ | 120,000 | — | $5,000 | 3 | $ | 216,000 | |||||||||||

Dallas S. Clement4 | — | — | — | — | — | |||||||||||||||

Paul R. Garcia | $ | 106,000 | $ | 120,000 | — | $5,000 | 3 | $ | 231,000 | |||||||||||

David H. Hughes | $ | 88,000 | $ | 120,000 | — | $5,000 | 3 | $ | 213,000 | |||||||||||

M. Douglas Ivester | $ | 123,250 | $ | 120,000 | — | $9,000 | 2, 3 | $ | 252,250 | |||||||||||

Kyle Prechtl Legg | $ | 110,500 | $ | 120,000 | — | $5,000 | 3 | $ | 235,500 | |||||||||||

William A. Linnenbringer | $ | 91,000 | $ | 120,000 | — | $5,000 | 3 | $ | 216,000 | |||||||||||

Donna S. Morea | $ | 86,500 | $ | 120,000 | — | $5,000 | 3 | $ | 211,500 | |||||||||||

David M. Ratcliffe | $ | 128,500 | $ | 120,000 | — | $5,000 | 3 | $ | 253,500 | |||||||||||

Frank P. Scruggs, Jr. | $ | 122,500 | $ | 120,000 | — | — | $ | 242,500 | ||||||||||||

Bruce L. Tanner4 | — | — | — | — | — | |||||||||||||||

Thomas R. Watjen | $ | 113,500 | $ | 120,000 | — | $5,000 | 3 | $ | 238,500 | |||||||||||

Phail Wynn, Jr. | $ | 113,500 | $ | 120,000 | — | $5,000 | 3 | $ | 238,500 | |||||||||||

| 1 | We make an annual equity grant with a grant date fair value of approximately $120,000 to each person who is serving as a director following our annual meeting of shareholders. In accordance with SEC regulations, we report in this column the aggregate grant date fair value of stock awards computed in accordance with FASB ASC Topic 718, but (pursuant to SEC regulations) without reduction for estimated forfeitures. Please refer to note 15 to our financial statements in our annual report for the year ended December 31, 2015 for a discussion of the assumptions related to the calculation of such value. As of December 31, 2015, each director named in the table above (except for Messrs. Clement and Tanner) held 2,916 shares of restricted stock or restricted stock units which vest on April 26, 2016, and none of our directors held any unexercised options (vested or unvested). |

| 2 | Reflects $4,000 fee for service on local advisory boards of our subsidiaries. No director received perquisites or personal benefits in 2015 in excess of $10,000. |

| 3 | Reflects matching contributions paid to a charity identified by the director. |

| 4 | Did not join the Board of Directors until December 17, 2015. |

| SunTrust Banks, Inc. - 2016 Proxy Statement | 7 |

Corporate Secretary. You may contact our Governance

Corporate Secretary, Raymond Fortin, by mail at SunTrust Banks, Inc., Post Office Box 4418, Mail Code 643, Atlanta, Georgia 30302, Attention: Corporate Secretary. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered a shareholder of record with respect to those shares. Shareholders of record residing at the same address and currently receiving multiple copies of the Proxy Statement may contact our registrar and transfer agent, Computershare Trust Company, N.A. (“Computershare”), to request that only a single copy of the Proxy Statement be mailed in the future. Contact Computershare by phone at (866) 299-4214 or by mail at 250 Royall Street, Canton, MA 02021. If your shares are held in a brokerage account or bank, you are considered the “beneficial owner” of those shares. Beneficial owners should contact their broker or bank.

Record Date and Shares OutstandingEach common shareholder of record at the close of business on February 13, 2013—the record date—is entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. Each share of SunTrust common stock entitles the holder to one vote on any matter coming before a meeting of our shareholders. Our Perpetual Preferred Stock, Series A, Perpetual Preferred Stock, Series B, and Perpetual Preferred Stock, Series E generally are not entitled to vote. On February 13, 2013, the record date for the Annual Meeting, there were

Our Bylaws provide for the annual election of directors. The Bylaws further provide that, in an election of directors in which the only nominees for election are persons nominated by the Board (an “uncontested election”), in order to be elected, each nominee must receive more votes cast for such nominee’s election than against such nominee’s election. If the director election is not an uncontested election, then directors are elected by a plurality of the votes cast. In connection with uncontested director elections, votes cast exclude abstentions with respect to a director’s election.

If a nominee who currentlypresently serves as a director does not receive the required vote for re-electionreelection in an uncontested election, Georgia law provides that such director will continue to serve on the Board as a “holdover” director. Georgia corporate law generally gives such unelected “holdover” directors all of the same powers as directors elected by a majority vote until such holdover-director’s successor is elected and qualified. A successor cannot be elected until there is another meeting of shareholders, and these typically occur only once a year unless we incur the time and expense of a special meeting of shareholders. To prevent holdover directors from remaining on our board, and to better effectuate the intentions of our shareholders, our Corporate Governance Guidelines require such a director to tender his or her written resignation to the Chairman of the Board for consideration by the Corporate Governance and Nominating Committee (the(which we refer to in this section as the “Committee”) within five days following certification of the shareholder vote.

However, the resignation of a director may adversely affect us. For this reason, we do not make resignations tendered in such context automatically effective. Rather, after the director submits his or her mandatory resignation, the Committee will then consider the resignation and, within 45 days following the shareholders’ meeting at which the election occurred, make a recommendation to the Board concerning whether to accept or reject the resignation. In determining its recommendation, the Committee will consider all factors deemed relevant by the Committee members including, without limitation, theany stated reason or reasons why shareholders did not vote for the director’s re-election,reelection, the qualifications of the director (including, for example, whether the director serves on the Audit Committee as an “audit committee financial expert” and whether there are

appropriate, including, without limitation, acceptance of the resignation, rejection of the resignation, or rejection of the resignation coupled with a commitment to seek to address and cure the underlying reasons reasonably believed by the Committee to have substantially resulted in the failure of the director to receive the necessary votes for re-election.

To constrain the Board’s discretion in considering such resignations, we have adopted specific procedural requirements in our Corporate Governance Guidelines. In addition to the 45-day deadline above, our Corporate Governance Guidelines require the Board to take formal action on the Committee’s recommendation no later than 75 days following the shareholders’ meeting at which the election occurred. In considering the Committee’s recommendation, the Board will consider the information, factors and alternatives considered by the Committee and such additional information, factors and alternatives as the Board deems relevant. Our Corporate Governance Guidelines require us to publicly disclose the Board’s decision in a Current Report (Form 8-K) filed with the Securities and Exchange Commission together with an explanation of the process by which the Board made its decision and, if applicable, the Board’s reason or reasons for rejecting the tendered resignation, within four business days after the Board makes its decision. No director who is required to tender his or her resignation may participate in the Committee’s deliberations or recommendation, and the Corporate Governance Guidelines contain provisions addressing how the determination of whether to accept or reject a resignation is made if a majority of the members of the Committee fails to receive the necessary vote for re-election.reelection. Generally, in such case, the determination will be made by independent directors who received the necessary vote for election or re-election.reelection. If the Board accepts a director’s resignation, then any resulting vacancy may be filled by the Board in accordance with the Bylaws, or the Board in its discretion may decrease the size of the Board pursuant to the Bylaws.

The Board has determined that all of our directors are independent, except for Mr. Rogers, who is our Chairman and Corporate Governance and Director IndependenceCEO, are independent.CEO. Specifically, it determined that the following current directors are

| 8 | SunTrust Banks, Inc. - 2016 Proxy Statement |

Corporate Governance

executive officer, or person nominated or chosen by us to become a director or executive officer.

We include our independence standards in our Corporate Governance Guidelines. You can view these on our Investor Relations website, www.suntrust.com,investors.suntrust.com under the headings “About Us” and “Corporate heading “Governance.” An independent director is one who is free of any relationship with SunTrust or its management that may impair the director’s ability to make independent judgments. In determining director independence, the Board broadly considers all relevant facts and circumstances, including the rules of the New York Stock Exchange. The Board considers the issue not merely from the standpoint of a director, but also from that of persons or organizations with which the director has an affiliation. The Board pays particular attention to whether a director is independent from management and to any credit relationships that may exist with a director or a related interest. In doing so, the Board considers, among other things, all extensions of credit between the Company and the director (including his or her related interests).

Generally, we do not consider independent any director who is an executive officer of a company that makes payments to us, or receives payments from us, for property or services in an amount which, in any year, exceeds the greater of $1 million or 2% of such company’s consolidated gross revenues. We also do not consider independent any director to whom we have extended credit, or who is also an executive officer of a company to which we have extended credit, unless such credit meets the substantive requirements of Federal Reserve Board Regulation O. Regulation O requires that, when making loans to our executive officers and directors, we do so on substantially the same terms, including interest rates and collateral, and followingfollow credit-underwriting procedures that are no less stringent than those prevailing at the time for comparable transactions by SunTrust with other persons not related to the lender. Such loans also may not involve more than the normal risk of collectability or present other unfavorable features. Additionally, no event

We have a policy requiring directors who change the job responsibility they held when they were elected to the Board to submit a letter of resignation to the Board. We also have a policy requiring directors to retire from the Board upon the first annual meeting following their 72nd birthday (65th birthday for employee-directors). If the director desires to continue to serve after he or she tenders his or her resignation pursuant to such policies, he or she may do so only after the Board, through its Governance and Nominating Committee, has made a determination that continued Board membership is appropriate. Blake P. Garrett and G. Gilmer Minor will reach our mandatory retirement age (72) prior to the Annual Meeting and will retire from the Board following this year’s Annual Meeting of Shareholders.

We have a Senior Financial Officers Code of Ethical Conduct that applies to our senior financial officers, including our principal executive officer, principal financial officer and principal accounting officer. We also have a Code of Conduct that applies to all employees and a Code of Business Conduct and Ethics for members of the Board. These three Codes of Conduct, as well as our Corporate Governance Guidelines, and the charters for the Executive Committee,each of the Audit, Committee, theCompensation, Executive, Governance and Nominating Committee, theand Risk Committees

Compensation Committee andof the Risk Committee,Board can be found by clickingon our Investor Relations website, investors.suntrust.com, under the heading “About Us” on our website at www.suntrust.com and then clicking on “Corporate “Governance.”

CEO and Management SuccessionThe Board of Directors considers management evaluation and succession planning to be one of its most important responsibilities. Our Corporate Governance Guidelines specify that our Board of Directors is responsible for developing a succession plan for our CEO and other senior executive officers. Annually, the non-executive directors of the Board meet with the CEO to discuss his potential successors and related issues. After these meetings, the Board may update its CEO succession plan as appropriate. In addition, the CEO maintains in place at all times a confidential procedure for the timely and efficient transfer of his duties in the event of an emergency or departure. The CEO also periodically reviews with the non-executive directors the performance of other key members of the Company’s senior management, as well as any succession issues relating to those individuals.Board Leadership StructureOur Board is led by a Chairman selected by the Board from time to time. Presently, William H. Rogers, Jr., our CEO, is also Chairman of the Board. All of our other directors are independent. The Board has determined that selecting our CEO as Chairman is in our best interests because it promotes unity of vision for the leadership of the Company and avoids potential conflict among directors. The Board is aware of the potential conflicts that may arise when an insider chairs the Board, but believes these are offset by existing safeguards which include the designation of a lead director, regular meetings of the independent directors in executive session without the presence of insiders, the Board’s succession plan for incumbent management, the fact that management compensation is determined by a committee of independent directors who make extensive use of peer benchmarking, and the fact that much of our operations are highly regulated.Lead DirectorIn 2009, the Board established the position of Lead Director. The Board selected M. Douglas Ivester as Lead Director. The responsibilities and duties of the Lead Director include (i) presiding at meetings of the Board in the absence of the Chairman, including the executive sessions of the non-management members of the Board; (ii) serving as a liaison between the non-management directors and the Chairman of the Board; (iii) advising the

The Board oversees and monitors the Company’s risk management processes. The Board’s Risk Committee outlines our risk principles and management framework and sets high level strategy and risk tolerances. Our risk profile is managed by our Chief Risk Officer. The Chief Risk Officer is an executive officer appointed by and reporting to the Risk Committee and the CEO. The Chief Risk Officer meets at least quarterly with the Risk Committee of the Board. The chairChair of the Risk Committee makes a full report of each Risk Committee meeting to the full Board at each Board meeting. In addition, the Chief Risk Officer also meets with the full Board at each meeting. The Board also meets regularly in executive session without management to discuss a variety of topics, including risk. In these ways, the full Board is able to monitor our risk profile and risk management activities on an on-going basis. Additionally, the Company has other risk-monitoring processes. For example, certain financial risks are also monitored by officers who report to the Chief Financial Officer. In turn, the Chief Financial Officer and appropriate financial risk personnel attend the meetings of the Audit Committeeand Risk Committees of the Board. As with the Risk Committee, the Chair of the Audit Committee makes a full report of each Audit Committee meeting to the full Board at each Board meeting and, when circumstances warrant, the Chief Financial Officer and other financial risk personnel meet with the full Board.

We face ongoing and emerging risks and regulations related to the activities that surround the delivery of banking and financial products. Coupled with external influences such as market conditions, fraudulent activities, disasters, cyber-attacks and other security risks, country risk, vendor risk, and legal risk, the potential for operational and reputational loss remains elevated.

Our operations rely on computer systems, networks, the internet, digital applications, and the telecommunications and computer systems of third parties to perform business activities. The use of digital technologies introduces cyber-security risk that can manifest in the form of information theft, physical disruptions, criminal acts by individuals, groups, or nation states, and a client’s inability to access online services. We use a wide array of techniques to secure our operations and proprietary information such as Board approved policies and programs, network monitoring, access controls, dedicated security personnel, and defined insurance instruments, as well as consult with third-party data security experts.

To control cyber-security risk, we maintain an active information security program that conforms to FFIEC guidance. This information security program is aligned with our

| SunTrust Banks, Inc. - 2016 Proxy Statement | 9 |

Corporate Governance

operational risks and is overseen by executive management, the Board, and our independent audit function. It continually monitors and evaluates threats, events, and the performance of its business operations and continually adapts and modifies its risk reduction activities accordingly. We also have a cyber liability insurance policy that provides us with coverage against certain losses. expenses, and damages associated with cyber risk.

Further, we recognize our role in the overall national payments system and we have adopted the National Institute of Standards and Technology Cyber Security Framework. We also fully participate in the federally recognized financial sector information sharing organization structure, known as the Financial Services Information Sharing and Analysis Center. Digital technology is constantly evolving, and new and unforeseen threats and actions by others may disrupt operations or result in losses beyond our risk control thresholds. Although we invest substantial time and resources to manage and reduce cyber risk, it is not possible to completely eliminate this risk.

We believe that effective management of operational risk, defined as the risk of loss resulting from inadequate or failed internal processes, people and systems, or from external events, plays a major role in both the level and the stability of our profitability. Our Operational Risk Management function oversees an enterprise-wide framework intended to identify, assess, control, monitor, and report on operational risks Company-wide. These processes support our goals to minimize future operational losses and strengthen our performance by maintaining sufficient capital to absorb operational losses that are incurred.

The operational risk governance structure includes an operational risk manager and support staff within each business segment and corporate function. These risk managers are responsible for execution of risk management within their areas in compliance with our policies and procedures. The Risk Committee of our board oversees our risk management and receives reports from the Chief Risk Officer and others.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and any persons who own beneficially more than 10% of our common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. To our knowledge, based solely on a review of the reports furnished to us and written representations from reporting persons that all reportable transactions were reported, we believe that during the fiscal year ended December 31, 2015 our officers, directors and greater than 10% owners timely filed all reports they were required to file under Section 16(a), except for (1) a single late

filing by Mr. Clement which was 1 day late as a result of delays in obtaining electronic filing codes during the Christmas holiday, (2) Mr. Gillani’s inadvertent omission of 1,350 shares from his initial statement of beneficial ownership of securities on Form 3, and (3) a single late Form 5 by Mr. Ratcliffe to report a change in form of beneficial ownership.

We have no compensation committee interlocks. Messrs. Beall, Correll, Crowe, Garrett, Hughes,Garcia, Ratcliffe, and Ratcliffe,Scruggs, and Ms. Legg and Dr. WynnMs. Morea constitute all of the

During

Director CompensationThe Governance and Nominating Committee determines the amount and form of director compensation. Its procedures for determining director compensation are similar to those used by the Compensation Committee for executive compensation, described under the caption “Executive Compensation Decision-Making Processes.”We pay each non-employee director an annual retainer of $60,000 in four installments. The Chairs of each of the Risk Committee, Governance and Nominating Committee, Compensation Committee, and Audit Committee receive an additional retainer of $15,000, and the Lead Director receives an additional retainer of $25,000. We pay each non-employee director a fee of $1,500 for each committee meeting attended. Non-employee directors serving on the Board after our annual meeting of shareholders receive a grant of either restricted stock or restricted stock units, at their election, having a value of $120,000 on the date of grant. The grant vests upon the earlier of one year or the next annual meeting.The table below provides information concerning the compensation of our non-employee directors for 2012. Except as noted above, all of our non-employee directors are paid at the same rate.Directors may defer either or both of their meeting and retainer fees under our Directors Deferred Compensation Plan. We determine the return on deferred amounts as if the funds had been invested in our common stock or at a floating interest rate equal to the prime interest rate in effect at SunTrust Bank computed on the last day of each quarter, at the election of the director. In accordance with SEC regulations, we report only above-

| Name | Fees Earned or Paid In Cash | Stock(2) Awards | NQDC(3) Earnings | All(4) Other Compensation | Total | |||||||||

| Robert M. Beall, II | $90,000 | $120,010 | $210,010 | |||||||||||

| Alston D. Correll | $117,000 | $120,010 | $237,010 | |||||||||||

| Jeffrey C. Crowe | $118,500 | $120,010 | $238,510 | |||||||||||

| Blake P. Garrett, Jr. | $93,000 | $120,010 | $213,010 | |||||||||||

| David H. Hughes | $91,500 | $120,010 | $211,510 | |||||||||||

| M. Douglas Ivester | $139,000 | $120,010 | $17,000 | $276,010 | ||||||||||

J. Hicks Lanier(1) | $29,000 | (1) | $6,250 | $35,250 | ||||||||||

| Kyle Prechtl Legg | $126,000 | $120,010 | $246,010 | |||||||||||

| William A. Linnenbringer | $121,500 | $120,010 | $241,510 | |||||||||||

| G. Gilmer Minor, III | $94,500 | $120,010 | $214,510 | |||||||||||

| Donna S. Morea | $61,500 | $120,010 | $181,510 | |||||||||||

| David M. Ratcliffe | $118,500 | $120,010 | $238,510 | |||||||||||

Frank S. Royal, M.D.(1) | $29,000 | (1) | $4,322 | $33,322 | ||||||||||

| Thomas R. Watjen | $106,500 | $120,010 | $226,510 | |||||||||||

| Phail Wynn, Jr. | $85,500 | $120,010 | $205,510 | |||||||||||

| Membership by Director | |||||||||

| Audit | Compensation | Executive | Governance & Nominating | Risk | |||||

| Number of Meetings Held: | 13 | 8 | 6 | 6 | 15 | ||||

| Robert M. Beall, II | ü | ü | |||||||

| Alston D. Correll | Chair | ü | ü | ||||||

| Jeffrey C. Crowe | ü | ü | Chair | ||||||

| Blake P. Garrett, Jr.* | ü | ü | |||||||

| David H. Hughes | ü | ü | |||||||

| M. Douglas Ivester | ü | Chair | ü | ||||||

| Kyle Prechtl Legg | ü | ü | |||||||

| William A. Linnenbringer | ü | ü | |||||||

| G. Gilmer Minor, III* | ü | ü | |||||||

| Donna S. Morea | ü | ü | |||||||

| David M. Ratcliffe | ü | ü | |||||||

| William H. Rogers, Jr. | Chair | ||||||||

| Thomas R. Watjen | Chair | ü | ü | ||||||

| Dr. Phail Wynn, Jr. | ü | ü | |||||||

We recognize that related party transactions can presenthave the potential or actualto create conflicts of interest and create the appearance that Company decisions are based on considerations other than the best interests of the Company and our shareholders. Therefore, our Board has adopted a formal, written policy with respect to related party transactions.

For the purpose of the policy, a “related party transaction” is a transaction in which we participate and in which any related party has a direct or indirect material interest, other than (1) transactions available to all employees or customers generally, (2) transactions involving less than $120,000 when aggregated with all similar transactions, or (3) loans made by SunTrust Bank in the ordinary course of business, made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the lender, and not involving more than the normal risk of collectability or presenting other unfavorable features.

Under the policy, any related party transaction must be reported to the General Counsel and may be consummated or may continue only (i) if the Governance and Nominating Committee approves or ratifies such transaction and if the transaction is on terms comparable to those that could be

| 10 | SunTrust Banks, Inc. - 2016 Proxy Statement |

Corporate Governance

obtained in arm’s-length dealings with an unrelated third party, (ii)and if the transaction involves compensation, that has been approved by our Compensation Committee, or (iii) if the transaction has been approved by the disinterested members of the Board.Committee. The Governance and Nominating Committee may approve or ratify the related party transaction only if the

We have no transactions with related parties other than normal, We generally consider credit relationships with directors and/or their affiliates to be immaterial and as not impairing the director’s independence so long as the terms of the credit relationship are similar to those offered to other comparable borrowers. We use the following guidelines to determine the impact of a credit relationship on a director’s independence. We presume that extensions of credit which comply with Federal Reserve Regulation O Regulation O requires such loans to be made on substantially the same terms, including interest rates and collateral, and to follow In addition, we do not consider as independent any director who is also an executive officer of a company to which we have extended credit unless such credit meets the substantive requirements of Regulation O. We also do not consider independent any director who is an executive officer of a company that makes payments to, or receives payments from us, for property or services in an amount which, in any fiscal year, is greater than $1 million or 2% of such director’s company’s consolidated gross revenues.Transactions with Related Persons, Promoters, and Certain Control Personsarms’-lengtharm’s-length banking and other credit transactions that comply with Federal Reserve Regulation O. Our Board reviews these relationships, but for the reasons below, we do not view them as impairing a director’s independence.to beare consistent with director independence. In other words, we do not consider normal, arm’s-length credit relationships entered into in the ordinary course of business to negate a director’s independence.credit-underwritingcredit underwriting procedures that are no less stringent than those prevailing at the time for comparable transactions by SunTrust with other persons not related to the lender. Such loans also may not involve more than the normal risk of collectability or present other unfavorable features. Additionally, no event of default may have occurred (that is, such loans are not disclosed as non-accrual, past due, restructured, or potential problems). Our Board must review any credit to a director or his or her related interests that has become criticized in order to determine the impact that such classification has on the director’s independence.

Each committee and board meeting generally includes a meeting of the independent directors in executive session, and with respect to full board meetings, such meetings are presided over by a Lead Director selected by a majority of independent directors. M. Douglas Ivester presently serves as the Lead Director.

The Board of Directors considers management evaluation and succession planning to be one of its most important responsibilities. Our Corporate Governance Guidelines specify that our Board is responsible for developing a succession plan for our CEO and other senior executive officers. Annually, the non-executive directors of the Board meet with the CEO to discuss his potential successors and related issues. After these meetings, the Board may update its CEO succession plan as appropriate. In addition, the CEO maintains in place at all times a confidential procedure for the timely and efficient transfer of his duties in the event of an emergency or unexpected departure. The CEO also periodically reviews with the non-executive directors the performance and any succession issues of other key members of the Company’s senior management.

Our Board is led by a Chairman selected by the Board from time to time. Presently, William H. Rogers, Jr., our CEO, is also Chairman of the Board. All of our other directors are independent. The Board has determined that selecting our CEO as Chairman is in our best interests because it promotes unity of vision for the leadership of the Company and avoids potential conflict among directors. The Board is aware of the potential conflicts that may arise when an insider chairs the Board, but believes these are more than offset by existing safeguards which include the designation of a lead director, regular meetings of the independent directors in executive session without the presence of insiders, the Board’s succession plan for incumbent management, the fact that management compensation is determined by a committee of independent directors who make extensive use of peer benchmarking, and the fact that much of our operations are highly regulated.

In 2009, the Board established the position of Lead Director and selected M. Douglas Ivester as Lead Director. The responsibilities and duties of the Lead Director include (i) presiding at meetings of the Board in the absence of the Chairman, including the executive sessions of the non-management members of the Board; (ii) serving as a liaison between the non-management directors and the Chairman of the Board; (iii) advising the Chairman as to an appropriate

| SunTrust Banks, Inc. - 2016 Proxy Statement | 11 |

Corporate Governance

schedule of Board meetings and on the agenda and meeting schedules for meetings of the Board and its committees; and (iv) calling meetings of the non-employee directors and developing the agendas for and serving as Chairman of the executive sessions of the Board’s non-employee directors. A more complete description of this role is included in our Corporate Governance Guidelines, which we provide on our Investor Relations website, investors.suntrust.com, under the heading “Governance.” The Lead Director is appointed by a majority vote of the non-management directors for a one-year term, subject to renewal for a maximum of four additional twelve-month terms, and shall serve until the expiration of the term or until such Lead Director’s earlier resignation or retirement from the Board. Mr. Ivester’s term is scheduled to conclude in April 2016, although the Board may extend his term if they consider doing so to be in the best interest of the functioning of the Board and of shareholders.

Annually, the Board conducts a self-assessment, which our Governance and Nominating Committee reviews and discusses with the Board. In addition, each committee conducts an annual self-assessment of their performance. These assessments include both an evaluation of the effectiveness of the Board, each committee of the Board, and the annual assessment process itself.

We believe it is important to continually refresh the composition of the Board. We have a policy requiring directors who change the job responsibility they held when they were elected to the Board to submit a letter of resignation to the Board. We also have a policy requiring directors to retire from the Board upon the first annual meeting following their 72nd birthday (65th birthday for employee-directors). Robert M. Beall, II and David H. Hughes will reach mandatory retirement age prior to the Annual Meeting and will retire from the Board following this year’s meeting. If the director desires to continue to serve after he or she tenders his or her resignation pursuant to such policies, he or she may do so only after the Board, through its Governance and Nominating Committee, has made a determination that continued Board membership is appropriate. These policies have been effective in allowing us to refresh 11 of our 13 independent directors in the past 6 years.

Each year, the Board reviews management’s long-term business strategy. In November 2015, over the course of 3 days, it reviewed and approved the 2016-2018 strategic plan. In addition, the Board reviews management’s progress against key elements of its strategic plan at its regularly scheduled meetings throughout the year.

Director Qualifications and Selection Process

We maintain a standing Governance and Nominating Committee, which we refer to in this section as the Committee, comprised solely of independent directors who are responsible for identifying individuals qualified to become Board members and recommending director nominees to the Board. The Committee periodically reviews the size and composition of the Board and determines whether to add or replace directors. Under our Corporate Governance Guidelines, the Committee also periodically reviews with the Board the appropriate skills and characteristics required of Board members. You may access the Committee’s charter and our Corporate Governance Guidelines on our Investor Relations website, investors.suntrust.com, under the heading “Governance.”

The Committee and the Board consider a variety of sources in evaluating candidates as potential Board members. The Committee has for the last several years used search firms to identify additional qualified nominees. Evaluations of potential candidates to serve as directors generally involve a review of the candidate’s background and credentials by the Committee, interviews with members of the Committee, the Committee as a whole, or one or more other Board members, and discussions by the Committee and the Board. The Committee then recommends director candidates to the full Board which, in turn, selects candidates to be nominated for election by the shareholders or to be appointed by the Board to fill a vacancy. Messrs. Clement and Tanner, each of whom was identified by search firms retained by the Committee, were considered by the Committee and the Board in accordance with these procedures prior to joining the Board.

Director Qualifications. Directors are responsible for overseeing the Company’s business consistent with their fiduciary duty to shareholders. This significant responsibility requires highly-skilled individuals with various qualifications, attributes and professional experience. The Board believes that there are general requirements for service on the Board that are applicable to all directors and that there are other skills and experience that should be represented on the Board as a whole, but not necessarily by each director. The Board and the Committee consider the qualifications of directors and nominees individually and in the broader context of the Board’s overall composition and the Company’s current and future needs.

Qualifications for All Directors. In its assessment of each potential candidate, including those recommended by shareholders, the Committee requires that each director be a person of recognized high integrity with broad experience and outstanding achievement in their careers. The Board believes that each director should have, and expects nominees to have, the capacity to obtain an understanding of our principal operational and financial objectives, plans and strategies; our results of operations and financial condition; and our relative standing and that of our business segments in relation to our

| 12 | SunTrust Banks, Inc. - 2016 Proxy Statement |

Corporate Governance

competitors. Further, each director and nominee should have the ability to make independent, analytical inquiries, an understanding of the business environment, and the ability to devote the time and effort necessary to fulfill his or her responsibilities to the Company.

Specific Qualifications, Attributes, Skills and Experience to be Represented on the Board. The Board has identified the following particular qualifications, attributes, skills and experience that are important to be represented on the Board as a whole:

| • | Independence, determined in accordance with our Corporate Governance Guidelines; |

| • | Financial industry knowledge, which is vital in understanding and reviewing our strategy, which may include the acquisition of businesses that offer complementary products or services. Service on predecessor boards of directors, as well as specific experience at SunTrust as current or former executives that gives directors specific insight into, and expertise that will foster active participation in, the development and implementation of our operating plan and business strategy; |

| • | Executive experience, which gives directors who have served in significant leadership positions strong abilities to motivate and manage others and to identify and develop leadership qualities in others; |

| • | Accounting and financial expertise, which enables directors to analyze our financial statements, capital structure and complex financial transactions and oversee our accounting and financial reporting processes; further, the Committee considers it essential that the Audit Committee have at least one member who qualifies as an “audit committee financial expert”; |

| • | Governmental affairs, regulatory and risk management experience, which contributes to our identification and management of possible areas of risk and helps to maintain an efficient and productive company; further, the Committee considers it essential that the Risk Committee have at least one member who qualifies as an “risk management expert”; |

| • | Public company board and corporate governance experience, which provides directors a solid understanding of their extensive and complex oversight responsibilities and furthers our goals of greater transparency, accountability for management and the Board, and protection of our shareholders’ interests; |

| • | Diversity, which provides a variety of points of view and which contributes to a more effective decision-making process; however, the Board does not have a specific diversity policy, but considers diversity of race, ethnicity, gender, age, cultural background and professional experiences in evaluating candidates for Board membership. |

We highlight each director’s or nominee’s specific skills, knowledge, and experience that the Committee and Board relied upon when determining whether to nominate the individual for election in the biographies at pages 3-4. A particular nominee may possess other skills, knowledge or experience even though they are not indicated in the biographies at pages 3-4.

The Board believes that all of the director nominees are highly qualified. The director nominees have significant leadership experience, knowledge, and skills that qualify them for service on our Board, and, as a group, represent diverse views, experiences, and backgrounds. All director nominees satisfy the criteria set forth in our Corporate Governance Guidelines and possess the personal and professional characteristics that are essential for the proper and effective functioning of the Board. Each nominee’s biography above contains additional information regarding his or her experiences, qualifications and skills.

Shareholder Recommendations and Nominations for Election to the Board

Any shareholder may recommend persons for election to the Board. The Committee will evaluate candidates proposed by shareholders by evaluating such candidates in the same manner and using the criteria described above. The recommendation should state how the proposed candidate meets the criteria described above and should include the information required by our Bylaws, described below.

In accordance with our Bylaws, direct shareholder nominations of a director must be made in writing and must be delivered to or mailed to and received by our Corporate Secretary not more than 150 days and not less than 120 days prior to the first anniversary of the date on which we first mailed our proxy materials for the preceding year’s annual meeting of shareholders. Nominations should also include a complete description of any material economic or other interest of the proposing shareholder, the nominee, and their respective affiliates and associates in order to satisfy the requirements of our Bylaws and to allow us to satisfy the requirements of SEC Regulation 14A. This Proxy Statement and the enclosed proxy are being first mailed to our shareholders on or about March 14, 2016. Therefore, shareholder nominations for election at next year’s annual meeting must be received on or after October 15, 2016 and no later than the close of business on November 14, 2016.

If you wish to nominate a director, our Bylaws require that you provide the following information: (i) the name, age, business and residence addresses of the nominee; (ii) the principal occupation or employment of the nominee and an explanation of how the nominee meets the criteria used by us for the selection of directors as set forth in the subsection “Director Qualification and Selection Process;” (iii) the total number of

| SunTrust Banks, Inc. - 2016 Proxy Statement | 13 |

Corporate Governance

shares of our common stock that, to your knowledge, will be voted for the proposed nominee; (iv) the total number of shares of our common stock that, to your knowledge, are owned by the nominee; (v) the signed consent of the nominee to serve, if elected; (vi) your name and residence address; (vii) the number of shares of our common stock owned by you and any affiliates (and their names and addresses); (viii) a complete description of all material economic or other interest of the proposed nominee and the person making the nomination, and of their affiliates and associates, consistent with the requirements of our Bylaws and SEC Regulation 14A, and (ix) any other information relating to the nominee that SEC Regulation 14A requires us to disclose in solicitations for proxies for the election of directors.